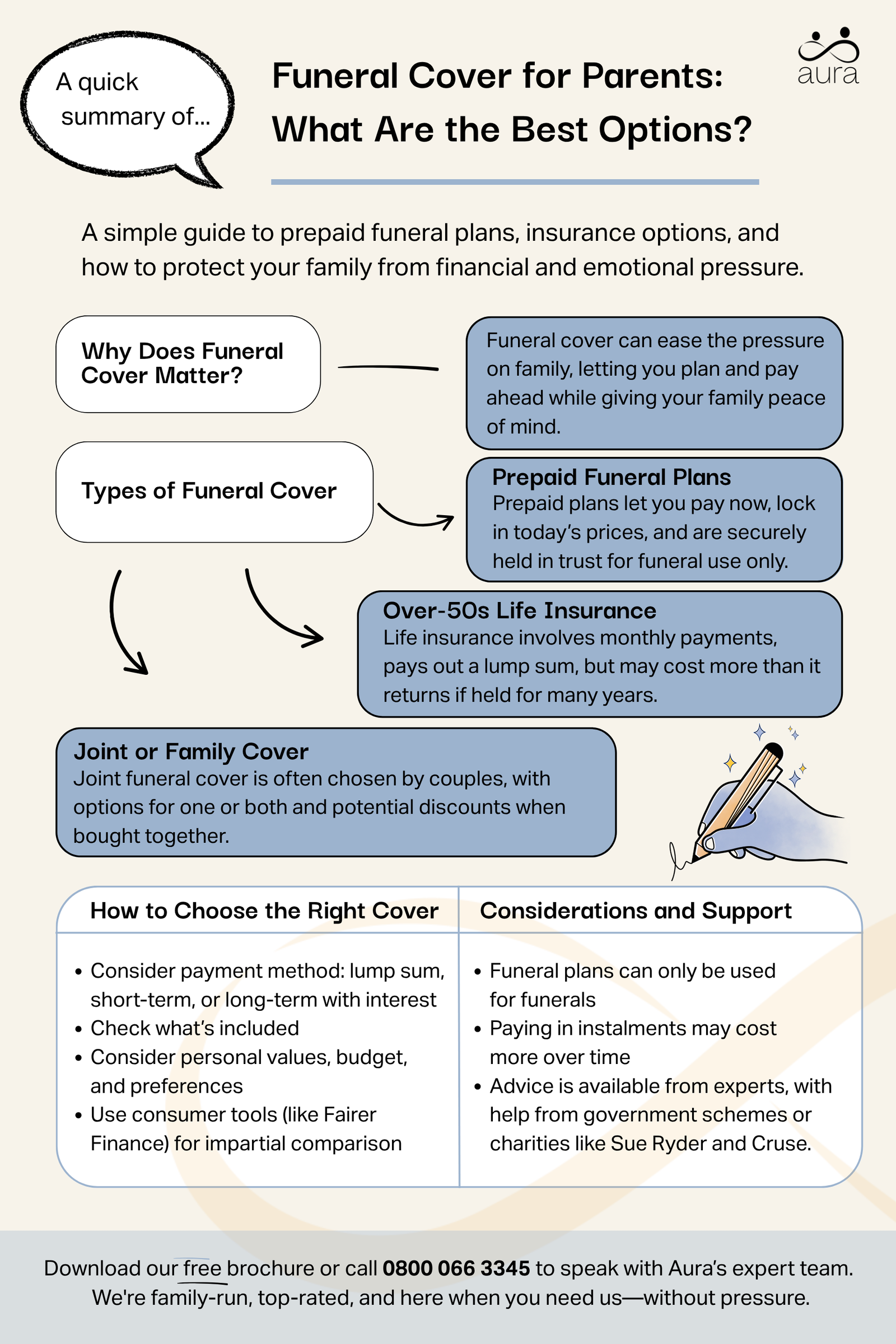

Understanding funeral cover for parents

There are different forms of funeral cover out there which suit the needs of different people, including options to buy a funeral plan for someone else.

Some people like to opt for a prepaid funeral plan, whereas others prefer something like funeral insurance or over-50’s life insurance. Each option has its own advantages and disadvantages, and whichever one you opt for will depend on your own funeral preferences and budget.

Whilst funeral plans are available to everyone, parents may find them especially beneficial. Prepaid funeral plans allow the planholder to organise and pay for their funeral in advance. They find a funeral director that suits their needs, share their wishes, and pay them the money they need to cover their funeral (either all in one go or over monthly instalments). Once they die, the plan is activated and the money they’ve paid the director is used for their funeral.

Parents might find them beneficial because they offer both the planholder and their family peace of mind. In purchasing a funeral plan, you will be able to breathe a sigh of relief knowing that all of your end-of-life wishes have been set out. Whereas your family will know that they won’t have to stump up at short notice to pay for your funeral without being able to discuss what you’d like. It’s this particular benefit that appeals to parents.

For your children, this kind of plan removes any uncertainty about does next of kin have to pay for the funeral – our guide on next-of-kin obligations confirms that having cover means your family won’t be forced to pay from their own pockets.

Sometimes, people may opt instead for a form of insurance, such as over-50s life insurance, to cover their funeral costs, rather than taking out a funeral plan.

With this model, fixed monthly premiums are paid from the point of sign-up either until death or until a certain birthday is reached, and, upon the death of the policy holder, the beneficiary of the policy will receive a cash lump-sum which can be used to cover funeral costs.

The end goal of a funeral cover, whether or not for parents, is to help us to cost effectively arrange and pay for funerals in advance.

Types of funeral cover available for parents

There are a range of different types of funeral cover available, from prepaid funeral plans to insurance policies and family funeral cover.

Prepaid funeral plans

Prepaid funeral plans are safe and secure financial products which allow you to pay for and plan your funeral in advance. In 2022, the industry became regulated by the Financial Conduct Authority (FCA), requiring all firms to be licensed before they could sell funeral plans. As part of this, firms have to guarantee the safety of the money of their customers; your money is protected under the Financial Services Compensation Scheme (FSCS), offering you an extra layer of financial security if the firm fails. This trust guarantees that the money needed to pay your funeral costs will always be there ready for when it’s needed, even if direct cremation prices continue to rise in the meantime.

Different plans include different things. For instance, with Aura, the price of hand-delivering the ashes back to the family after the cremation is included in the final price, but this isn’t always the case. It should also be borne in mind that, unlike with other forms of funeral cover, a funeral plan cannot be used for any other purpose besides paying for a funeral. In this sense, it’s not as flexible as over-50’s life insurance, the payout from which could theoretically be used for anything the beneficiary wants.

Which funeral plan is right for you?

If you’re not sure where to begin, think about the following:

- Budget-focused? A prepaid direct cremation plan is usually the most affordable.

- Want flexibility? Over-50s life cover may offer more choice on how the funds are used.

- Sorting a plan for a parent? Consider prepaid plans that don’t need medical checks.

- Prefer simple and quick? Choose a provider that offers online or phone setup, with clear paperwork.

Aura also offers a free brochure to help you compare options, or you can speak with one of our experienced arrangers for personalised advice. A summary of what’s included and excluded in each funeral plan will be provided in our Funeral Plan Summary, included in the brochure.

Funeral insurance policies, or over-50’s insurance

Insurance policies, such as an over-50’s life insurance policy, can payout a lump-sum which can be used towards funeral costs. The policy holder pays the insurance company monthly premiums (which are normally fixed at the point of sign-up for the duration of the policy) until the point at which you die, or reach a certain age (for instance your 90th birthday).

Those relying on life insurance to help their family cover funeral costs should bear a couple of things in mind, especially when choosing a funeral plan.

The first thing is that, depending on when you started paying for the policy, the amount of money you have paid the insurer by the point of payout may be more than the value of the lump-sum. This means it could, in the long run, be more convenient and cost-effective to just keep your money in a bank account. Two other important things to bear in mind are that the policy may be void depending on the cause of death, or if payment(s) were missed.

You should also bear in mind that such insurance is available under ‘fixed term’ or ‘whole of life’ arrangements. With the former, the policy is designed to cover a finite period of the policy holder’s life, i.e., 10 years, whereas the latter is infinite. Once the time of the former example elapses, a new policy will simply need to be started all over again, if you want to remain covered.

Family funeral cover policies

It’s possible to take out a joint life-insurance policy, perhaps for you and your spouse. Some couples find this less hassle and more convenient. It will usually payout after the death of the first insured person, perhaps with the second person as a beneficiary. With funeral plans, whilst they can’t work in this way , some providers, like Aura, offer the option to buy two together, often at a reduced cost. This allows you and someone dear to you to put your end-of-life plans in place together, and to save in the process. For instance, our starting price for an unattended direct cremation funeral plan is * £1,695, whereas the price for two together is £3,240; a combined saving of £100.

*Prices correct at time of writing. Additional services may incur extra charges.