Written by Adam McIlroy.

20 minute read

Article reviewed by Helen Hardware, Former Head of Risk & Compliance at Aura on March 5, 2025.

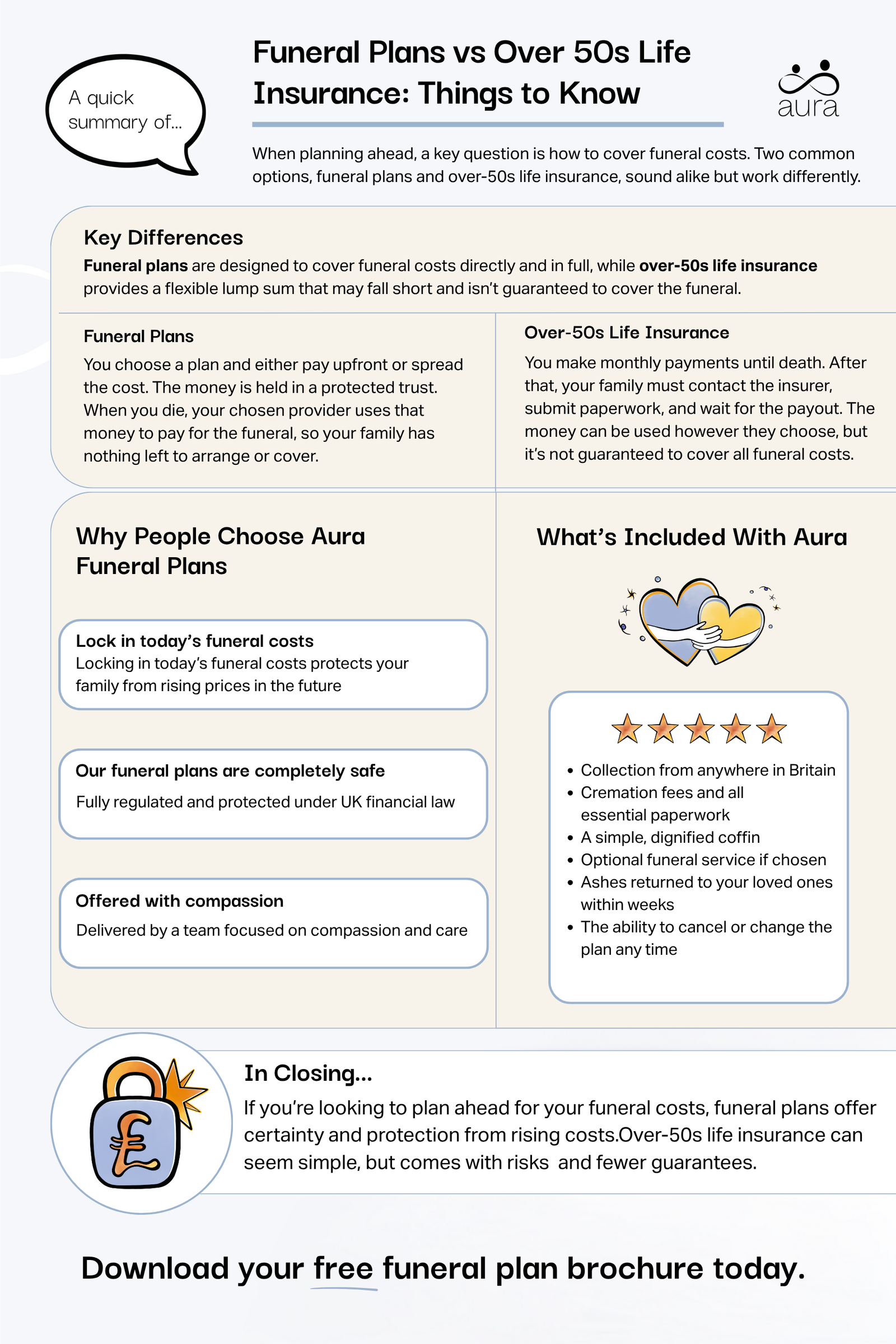

If we’re starting to plan ahead for our end-of-life wishes, one of the first things we need to consider is how we’re going to pay for it. There are two main options available to us in covering our future funeral costs: funeral plans, or an over-50s’ life insurance policy.

In this article we want to compare funeral plans vs over 50s life insurance, and asking what is a funeral plan, what is over-50s life insurance, and, crucially, whether they both guarantee that our funeral will be paid for. For those considering these choices on behalf of their mum or dad, exploring funeral cover for parents can provide guidance on the most suitable way to ensure no remaining costs fall on family members.

Key Takeaways

A prepaid funeral plan, sometimes called an over 50’s funeral plan, is a type of financial product designed to give peace of mind to those thinking ahead about end-of-life planning.

Funeral costs are rising year on year, often at a rate faster than inflation, making it difficult to answer “How much does a funeral cost?” at any given time. With Aura, you can purchase a plan that is guaranteed to cover the costs of your funeral when the time comes, regardless of how long that takes. One of the main benefits of this is that it helps your family to avoid any sudden and unnecessary expenses when they are grieving your loss, because everything will already have been paid for in advance.

For loved ones, this means no sudden worry about does next of kin have to pay for funeral costs – as our next-of-kin funeral costs guide explains, a prepaid plan spares your family from having to cover expenses themselves.

All funeral plan providers must be authorised by the Financial Conduct Authority (FCA). It means that, once you select a provider, in order to protect your money, they must do one of two things: place the money in an independent, secure trust, or back it with insurance.

Aura opts to place your money into a secure, independently managed trust separate from its business, ensuring your funds are safe for funeral services. It means that your money has full protection in the highly unlikely event that we can’t deliver on your plan. As an added layer of protection, Aura is signed up to the Financial Services Compensation Scheme (FSCS), meaning that in similar circumstances, you could have the right to compensation.

A funeral plan has a fixed cost, and many providers allow you the choice to pay all in one go, or to pay in instalments. With Aura, your final price is the same either way, as we don’t charge a fee on monthly instalments.

The best funeral plans offer you what you want at a reasonable price, and give you security and flexibility. We also don’t charge you an admin fee if you’d like to cancel or amend things; we know that sometimes life can step in and lead us to change plans, which is why we’ve specifically designed our services to be flexible for you.

The other main way in which people plan for their funerals is through funeral insurance for over 50s, also known as over-50s’ life insurance coverage. It’s a different kind of financial product to a funeral plan (also regulated by the FCA), with the main difference being that any payout can be used by the beneficiary however they see fit.

The policyholder pays a premium every month which may vary in line with their age. But, once the policy is taken out, the premiums are fixed for the duration of the policy and cannot be changed.

What many people like about over-50s’ life insurance policies is that they are non-medical, meaning that coverage is guaranteed without a medical exam, which is beneficial when considering funeral services.

There is something important to consider with over-50s’ life insurance which isn’t necessarily made clear to people when they sign up. There may come a point where the amount of money that has been paid into the policy will be more than than the fixed payout that the beneficiary is set to receive.

That’s because that fixed payout, as pointed out by Money Saving Expert, is “eroded” every year by inflation and, potentially, by your longevity. However, to put it bluntly, this is only a problem if you take out the policy early and continue paying for many years. Over-50s’ insurance policies can pay out more than you have paid in if you die shortly after you’ve signed up. However, normally there won’t be a payout at all unless premiums have been paid for at least one year.

This is one of the main reasons that we tend to arrange life-insurance cover for ourselves, but the truth is that over-50s’ life insurance may not be enough to cover the cost of our funeral. If this is the only thing we’ve got in place, our loved ones could still be left with expenses to pay.

The only thing which will ensure your funeral is paid for is a funeral plan, as it has been built for that very purpose. Aura’s funeral plans fix your costs at today’s prices, guaranteeing that there’ll be nothing left to pay by your family when the time comes.

Funeral plans and life insurance policies cover funeral costs in different ways. A funeral plan is specifically designed to cover the expenses associated with a funeral, including a service, coffin, and cremation. It guarantees that everything is paid for ahead of time and can’t be used for anything else, ensuring funds are allocated towards funeral costs.

Life insurance, on the other hand, pays out a lump sum to beneficiaries. Your loved ones may not have immediate access to it, and it can be used for various expenses, not just the funeral. Depending on how old you are when you start paying in, you may get less out than you paid in.

A comprehensive Aura funeral plan pays your funeral costs directly, without delay or uncertainty about the payout. Aura’s funeral plans also lock in current prices, protecting against future inflation and rising costs associated with funeral services. Life insurance payouts cannot do this because they are fixed at the beginning, whereas our plans are designed to cover your funeral costs.

Funeral plans

If you decide to purchase an Aura funeral plan, you’ll pick someone close to you to be your ‘Nominated Representative’ — someone who knows that you have a funeral plan in place. When you die, they’ll notify us that it’s time to put your plan into action, at which point we will use the money that has been set aside in trust to pay for everything.

Once your death has been registered and we’ve helped your family to complete the legal paperwork, your funeral will go ahead with nothing left to pay by your loved ones.

Important things to note:

Life insurance

Over-50s’ life insurance, on the other hand, isn’t quite as simple as this. If you’re relying on this method for your family, when they want to claim under your policy, it could be more complicated. They’ll need to provide evidence and paperwork relating to your death and their relationship with you, but the insurance company is free to dispute their claim or to request more information. This could make an already difficult situation even harder to deal with through administrative headaches and worry.

It’s also worth noting that, while a funeral plan is reliable regardless of the circumstances of the death, there are some situations in which life insurance doesn’t pay out, even once the policy-holder has died. Furthermore, payouts are not certain to be exempt from taxation, according to Legal & General.

Another important detail is that most over-50s life insurance policies have no surrender value, meaning if you cancel the policy or stop paying, you won’t get any money back. It simply ends, and anything you’ve paid is lost. There’s also the possibility that, if you live long enough, you might end up paying more in premiums than the policy will ever pay out.

And finally, because the payout is fixed from the start, it won’t rise with possible inflation. Over time, that lump sum might not stretch as far as you’d though, especially if funeral prices continue rising faster than average costs.

Choosing between life insurance or a funeral plan depends on your priorities, whether you want a guaranteed service or more flexible funds for your family.

Now that we’ve compared features, risks and costs, here’s a structured way to decide what works best for you. Questions to ask yourself and your family:

If you’re unsure which option is right for your situation, consider speaking to a regulated financial adviser or visiting MoneyHelper for impartial support.

| Aura Prepaid Funeral Plan | Over-50s Life Insurance Policy | |

|---|---|---|

| Guaranteed to cover your funeral expenses? | ✅ | ❌ |

| Purpose-built to pay for a funeral? | ✅ | ❌ |

| Can I get my money back if I change my mind? | ✅ | ❌ |

| Does the money I pay keep pace with inflation? | ✅ | ❌ |

Another big thing it’s important to consider when we are thinking about whether to go for a funeral plan or over-50s’ life insurance is the flexibility. With an Aura prepaid funeral plan, you can cancel at any time for any reason – free of charge – and receive a full refund of everything you’ve paid us to date.

With an over-50s’ life insurance policy, if you decide you want to cancel and stop paying, you will lose it all. You will not receive a refund of the premiums you’ve paid up until that point, and you will no longer be covered. This may also be the case in situations where, either by mistake or through financial difficulty, you miss a monthly payment.

We do our best to make sure there are no nasty surprises for your family when the time comes, making your quote as cost-effective and affordable as possible. Here’s what’s included as standard with an Aura funeral plan:

We’ve spotted that many providers will offer what looks like a low price for their services towards funeral costs, without including these things in your quote, meaning their prices can creep up unexpectedly.

It’s a good idea, when you come to compare funeral plans, that you understand what your final price gives you.

There are lots of different options out there on the market for funeral plans, but we are proud to say that ours are unique. Here are just a few of the reasons why:

When we say that our plans are all inclusive, we mean exactly that. With Aura you will truly get peace of mind knowing that your funeral wishes, and their costs, are all taken care of in advance. We want to help you and your family avoid as much unnecessary hassle and expense as possible, both now and when the time comes.

We want you to feel free to decide whatever you like, even if that is to completely cancel things. Aura makes it easy for you to make changes to your plan, whether to expand it or cancel it, by making it free of charge. Our end-of-life wishes are a very personal matter, so we want to help make things as dignified and respectful as possible.

According to SunLife, the national average total cost of a funeral was £5,140 in 2025. We hope it comes as a pleasant surprise to know that our funeral plans start at less than half this price. What’s even better is the fact that you can decide to pay all in one go, or in monthly instalments over 12-to-24 months, and your final price will be the same.

For those looking for something more straightforward, direct cremation prices tend to be much lower than traditional funeral costs, as they remove many of the elements that typically add to the final bill.

The families we’ve cared for have made us the top-rated direct cremation services provider on Trustpilot with a score of 4.9/5 stars – and we couldn’t be prouder. But that’s not all: we’re currently the only direct cremation services provider with two five-star-rated plans on Fairer Finance, and our prepaid funeral plans have been given five stars by Funeral Solution Expert, alongside our other accolades and achievements.

Aura is a company that takes its compliance responsibilities seriously. If you decide to buy one of our plans, we’ll pay your money into a secure, independently managed trust. It will be protected there, safe and sound, until the day it’s needed to pay for your funeral, backed by FCA regulation and FSCS protection.

In June 2024, we were delighted to win the accolade for SME Compliance Team of the Year at the International Compliance Association’s (ICA) Compliance Awards. With us, you can trust that the safety of your money is our first concern.

The Aura Angel team cannot be found anywhere else. They are the secret to our success and the reason why so many families have put their trust in us. It’s their job to guarantee that your funeral plan is followed to the letter, and they do that by offering their special, people-focussed care. They’ll lead your family by the hand through the difficult times that will follow after you’ve gone, protecting them from administrative hassle, and making sure that you have the funeral you deserve.

Our simple prepaid direct cremation plans start at £1,695, with everything you need included in that price. Both you and a loved one can even get your plans sorted together and save up to £50. Remember that you can pay it all in one go or in instalments – whatever you’d prefer – at no extra cost.

Some who buy our funeral plans feel that it’s important for their family to be there on the day of their cremation, which we completely understand. Unlike many other providers, we offer you the chance to customise your plan with a ceremony at a local crematorium. We’ll help your family to design a ceremony with a celebrant or religious minister around your life, which can last between 15 and 45 minutes, depending on the option you choose:

*Subject to the terms and conditions of the selected crematoria*

Our attended options are also available to purchase jointly with a loved one from £4,840.

We hope this comparison of funeral plans with life insurance for over-50s’ was useful to you. If you’ve been wondering, what’s the best life insurance or funeral plan, the answer depends on your needs, but we’re always here to talk you through your options. Feel free to give us a call; we’d be glad to hear from you any time.

If you have any questions, would like a brochure or simply would like a chat through our services, our award-winning team is here to help.

Unlike other providers, we won’t hassle you with constant calls. We’ll simply ensure you have the information you need and leave you to come to a decision in your own time. When you’re ready for us, our team will be ready to help.

It depends on what you want the money to be used for. If your main goal is to make sure your funeral is fully paid for, a funeral plan might be the safer option. It’s purpose-built to cover funeral costs, and with providers like Aura, everything is arranged and paid for in advance — no delays, no stress for your family.

Life insurance, on the other hand, provides a lump sum your loved ones can use for anything. But that also means there’s no guarantee the money will go towards your funeral, and the payout might not arrive in time to help.

Many people choose to have both, using the funeral plan to take care of the essentials and life insurance to leave something extra behind.

Many people ask: does Martin Lewis recommend funeral plans? While Martin Lewis of MoneySavingExpert.com doesn’t directly recommend specific plans, he does offer detailed guidance on how they work. He often highlights that funeral plans can be a good option if you want to fix the cost of your funeral and remove financial pressure from your family.

However, he also stresses the importance of choosing an FCA-regulated provider, understanding exactly what is and isn’t included, and making sure your money is securely protected. Aura’s plans meet all of these criteria and are rated five stars by independent experts.

Over-50s life insurance can be worth it in some circumstances, but it might not always good value for everyone. These policies are easy to get, often without a medical, but they usually:

-Have no cash-in value if you cancel

-Can cost more in premiums than the final payout if you live long enough

-Pay a fixed amount that doesn’t rise with funeral inflation

-So while they offer peace of mind, it’s important to read the small print and understand the risks. For those wanting to guarantee funeral costs are covered, a funeral plan may be a better fit.

Funeral insurance (or a funeral plan) may be better if your main priority is covering the cost of your funeral directly. It pays the funeral provider — not your family — and ensures everything is taken care of.

Life insurance can offer more flexibility but also more uncertainty. Your family can use the money however they like, but it may not be enough — and it may not arrive in time.

In short: if you want to take the pressure off your family and lock in today’s funeral costs, a funeral plan is can be the better choice.

They can be, yes. A funeral plan is worth it if you want certainty and simplicity, and you don’t want your family to face unexpected costs or admin when the time comes.

With a provider like Aura, your plan includes everything needed for a respectful cremation, and your money is kept in a secure, independent trust. You can cancel any time for a full refund, and you won’t pay more if you choose to spread the cost.

The key is choosing a plan that’s transparent, regulated, and all-inclusive.

The biggest difference is in how the money is used and when it’s paid.

A life insurance policy pays a lump sum to your family, which they can use for anything, not just your funeral. It may not arrive straight away, and might not be enough to cover costs.

A funeral plan pays the funeral provider directly, ensuring that the funeral is fully arranged and covered in advance, without your family needing to do anything.

So, life insurance is flexible, but a funeral plan offers peace of mind that everything will be handled just as you intended.

Not necessarily. If your funeral plan covers everything you want, you don’t need separate insurance to pay for your funeral. That part is already taken care of.

However, some people also choose to take out life insurance to leave extra money behind for their family for bills, debts, or personal wishes. So while you don’t need both, having both can sometimes make sense depending on your goals.